The following was written by Dean Foreman, Ph.D., Chief Economist at the Texas Oil & Gas Association (TXOGA):

At the midpoint of 2024, TXOGA’s weekly, monthly, and quarterly monitoring of the global, U.S., and Texas economies have indicated that all remain on track for resilient growth in 2024 and 2025. Yet, while the consensus view has increasingly aligned with these solid expectations, the balance of economic and energy market risks on the horizon appears to have shifted, raising discrete possibilities that global prospects depend on the outcomes of a handful of key assumptions.

This article delves into the latest insights from our monitoring and analyses, with critical implications for American households and businesses, core to energy security and affordability, and especially important to Texas.

Is the Global Economy on Cruise Control?

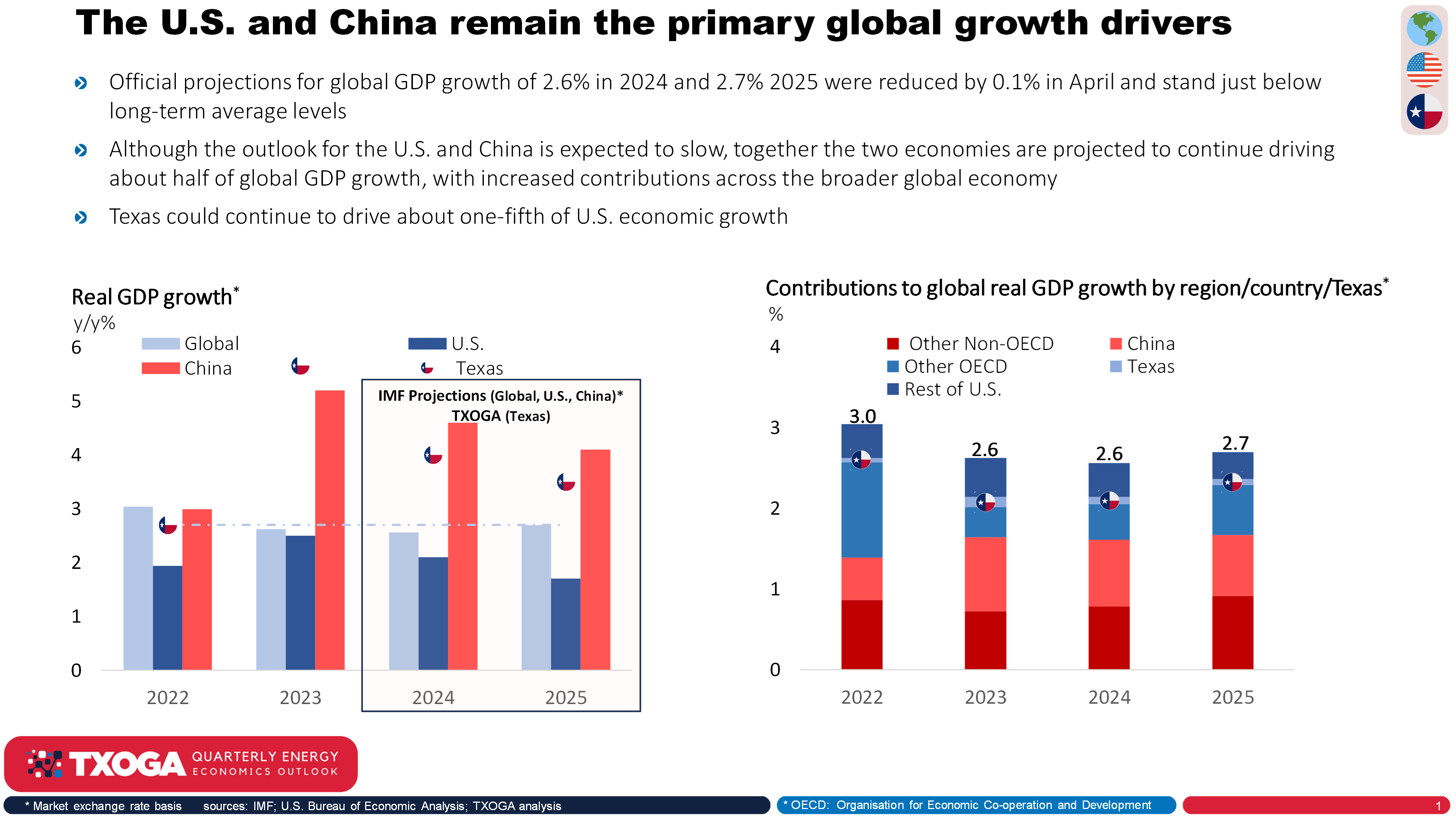

As discussed in the Q1 2024 perspective, , the International Monetary Fund (IMF) and others have raised their economic growth expectations to near the world’s long-run average growth rate for this year and the next. At all levels, the global economy has withstood the effects of high interest rates but is reliant on the U.S. and China together to drive half of global GDP growth this year.

In the U.S., we see perceptible recent increases in household delinquencies on credit cards, auto loans, and mortgages, which have collectively amounted to record highs above $17.5 trillion, per the New York Federal Reserve Bank. These developments reflect sticky price inflation, notably for services, as well as continued labor market tightness, which gives the U.S. Federal Reserve pause in beginning to cut the Federal Funds rate. Consequently, the U.S. dollar’s broad foreign exchange value has remained historically strong, which helps to counter price inflation but has also spurred U.S. imports to the tune of a $1 trillion annualized trade deficit that has dragged on economic growth.

In fact, U.S. economy expanded by a revised estimate of only 0.4% year-over-year (y/y) in Q1 2024, due almost entirely to consumer spending growth per the Bureau of Economic Analysis. Therefore, consumers are the crux of the outlook, and how they perceive their wealth and prospects is consequential to broader spending and economic growth.

The University of Michigan’s consumer sentiment index has historically corresponded with changes in consumer spending, and the index has notably lost traction with a 10.5% m/m drop between April and May. This reflected consumers’ concerns for high interest rates and price inflation, which have persisted despite an all-time high in the U.S. stock market as measured by the S&P 500. How financial markets respond to near-term economic developments is therefore a key uncertainty.

Meanwhile, China’s economic news has been conflicted, with indications of growth in services but contractions in goods and exports, which would not be helped by proposed U.S. import-tariff increases on China’s semiconductors, electric vehicles, steel, and batteries. Yet, as we also highlighted in the Q1 2024 perspective, the expectations for China’s growth coming into this year were exceptionally low. The IMF projected 2024 China real GDP growth of 4.1% y/y in January, raised this to 4.6% y/y in late February, and now to 5.0% y/y as the end of May. Since China’s economy is nearly one-fifth of the global economy on a market exchange rate basis, these upgrades alone have added 0.2% to global GDP growth. Strong global economic growth has maintained a consistent relationship with oil demand.

Record Oil Demand and Geopolitical Uncertainties, Yet No Apparent Shortages

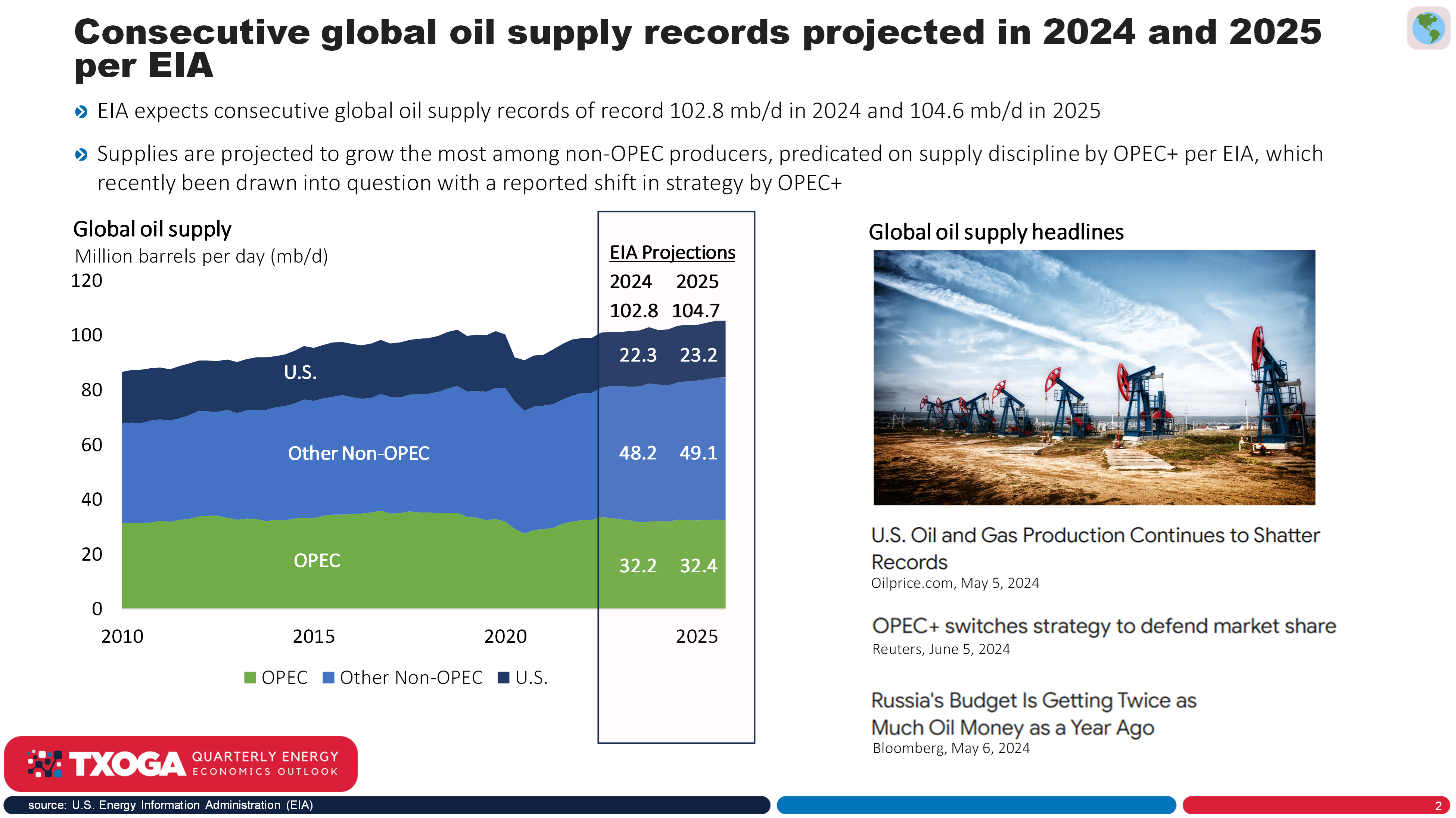

Notwithstanding economic uncertainties, this backdrop has supported global oil demand over 102 million barrels per day (mb/d) so far in Q2 2024, and the Energy Information Administration (EIA) projects repeated quarterly records above 103 mb/d beginning as soon as next quarter.

While demand has consistently grown along with the economy, the sources of competing supplies have thickened the plot this quarter. Long-lead projects in Brazil, Canada, and Guyana have added 1.0 mb/d to global supply in Q2 2024 compared with a year ago, as anticipated in official projections. However, the surprising productivity and strength of U.S. production, which itself has added more than 0.5 mb/d y/y, has generated a potential tipping point for OPEC+ to reconsider guarding its market share by expanding supply this summer.

Texas and the Permian Basin Warrant a Global Focus

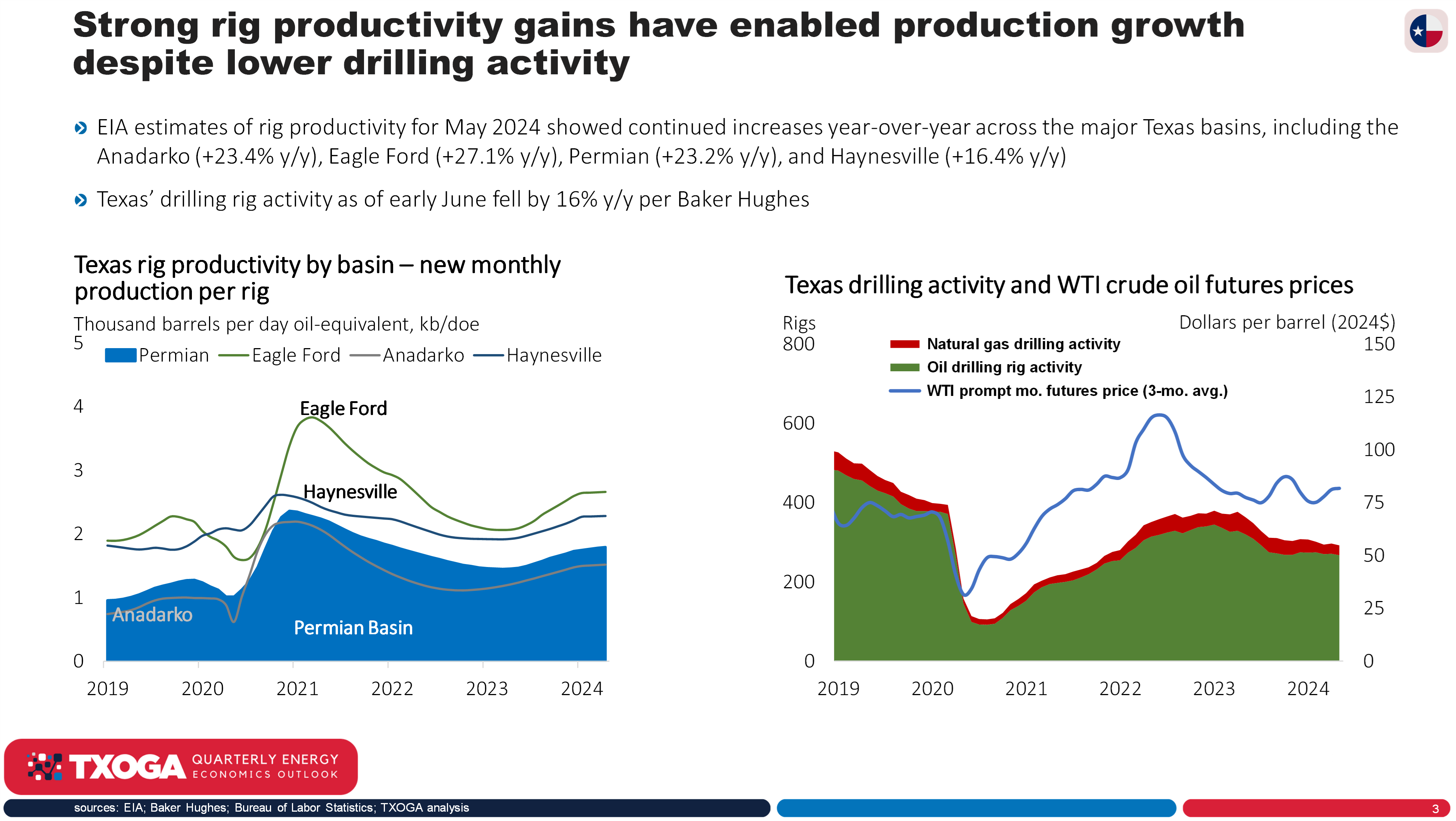

U.S. supplies have largely grown due to the Permian Basin’s remarkably strong performance. EIA estimates of rig productivity for May 2024 show continued increases y/y across the major Texas basins, including the Anadarko (+23.4% y/y), Eagle Ford (+27.1% y/y), Permian (+23.2% y/y), and Haynesville (+16.4% y/y). Especially given the Permian Basin’s massive scale – a May 2024 output of 6.2 mb/d of crude oil and over 25 billion cubic feet per day (bcf/d) of natural gas per the EIA, with roughly 70% stemming from Texas and 30% from New Mexico – even small productivity gains can be consequential. But increases across the board in excess of 20% y/y are tectonic in their scale and potential global market impact.

In turn, this progress has continued to elevate Texas on the global energy stage. TXOGA’s Monthly Energy Economics Reviews (MEER) highlight Texas’ record-breaking achievements. TXOGA’s projections through June 2024 show that Texas’ production remains historically strong at 5.7 mb/d of crude oil, 3.6 mb/d of NGLs, and 32.4 bcf/d of natural gas marketed production, accounting for 42.9% of U.S. crude oil and 28.3% of U.S. natural gas marketed production in the first half of 2024. Furthermore, Texas refinery activities have also broken their records with net production of 5.5 mb/d as of March 2024, also supporting a record five consecutive months with Texas’ petroleum product exports exceeding 4.0 mb/d.

As the global demand for energy and consumer goods continues to rise, Texas remains a leader in meeting these needs with unparalleled production and innovation. The Permian Basin’s growth, coupled with record-breaking outputs in oil, natural gas, and refined products, underscores Texas’ pivotal role in securing energy security and affordability. As TXOGA’s analyses reveal, the molecules essential to 96% of consumer goods begin their journey from oil and natural gas, solidifying Texas’ position as a cornerstone of both the national and global economies. In an era where economic and geopolitical uncertainties abound, Texas is not only driving growth but also ensuring the foundational elements of modern life remain accessible and affordable to all. The Lone Star State’s relentless pursuit of excellence in energy production reaffirms its status as an indispensable leader on the world stage, poised to navigate and shape the future of global energy dynamics.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.