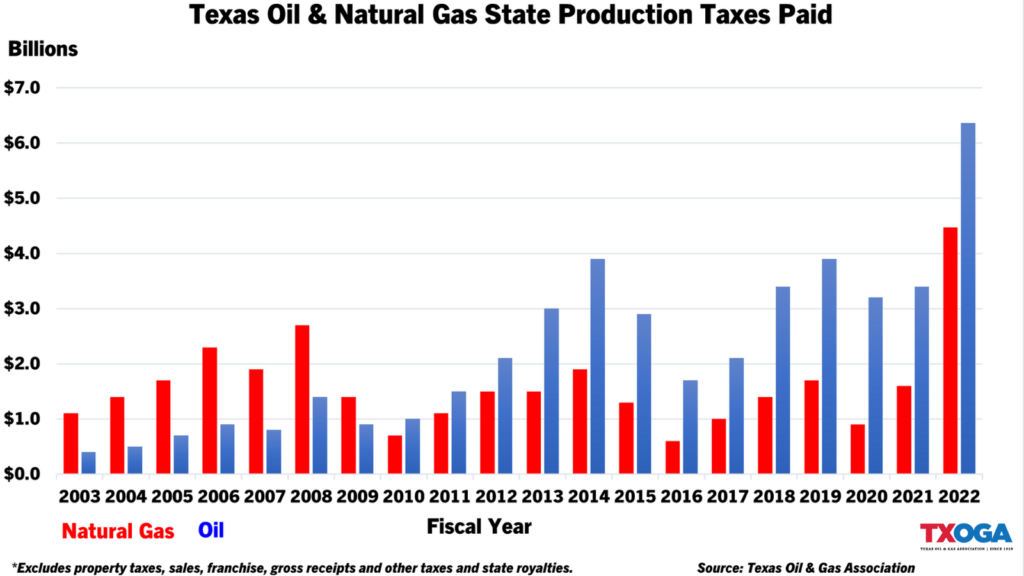

Annual Oil and Gas Tax Collections 88% Higher than Previous Record in 2014

September 2, 2022

AUSTIN — Texas Comptroller Glenn Hegar’s recently released tax collections data indicates production taxes paid by the oil and natural gas industry to the State of Texas broke $10 billion for the first time in history — an incredible $10.83 billion for FY 2022.

Both oil and natural gas production taxes exceeded the annual revenue estimate prepared just this summer by the Comptroller. At $6.36 billion, oil beat its recent estimate by $134 million, and natural gas, at $4.47 billion, beat its estimate by $9 million.

Compared to last year, which was a robust year for production tax collections, oil production taxes were up 84% and natural gas production taxes were up 185%. At $10.83 billion, collections were 88% higher than the previous highest year, 2014.

In response, Todd Staples, president of the Texas Oil & Gas Association said, “Oil and natural gas activity continues to pay big dividends for all Texans. With all the good news and records set at this level of funding, it is hard to focus on one category but it truly is astounding to realize that a deposit of $3.64 billion will be made in both the Economic Stabilization Fund (ESF) and State Highway Fund (SHF). Highway improvement is fundamental to continued driver safety and economic growth. The ESF or Rainy Day Fund has been used to fund both public and higher education needs, retired teachers and our state police, among many other essential services for Texans. It is good to know that oil and natural gas companies are using their recent success to fund more research and development, lower emissions technology, and add jobs for more Texans. We need to continue policies at both the state and federal level that unleash American energy leadership and ensure this production occurs here at home so that we do not become dependent on foreign countries for our basic energy needs.”

Production taxes are only one of the many taxes that the Texas oil and natural gas industry pays. The industry also pays billions in property taxes on all assets, from producing minerals properties to pipelines to refineries and gas stations. State and local sales taxes also apply to many purchases made by the industry, raising billions more. There are further taxes, including the state’s franchise tax and gross receipts taxes imposed on natural gas utilities and pipelines, and millions of dollars in fees imposed by state government.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.