Our Industry

Economic Benefits

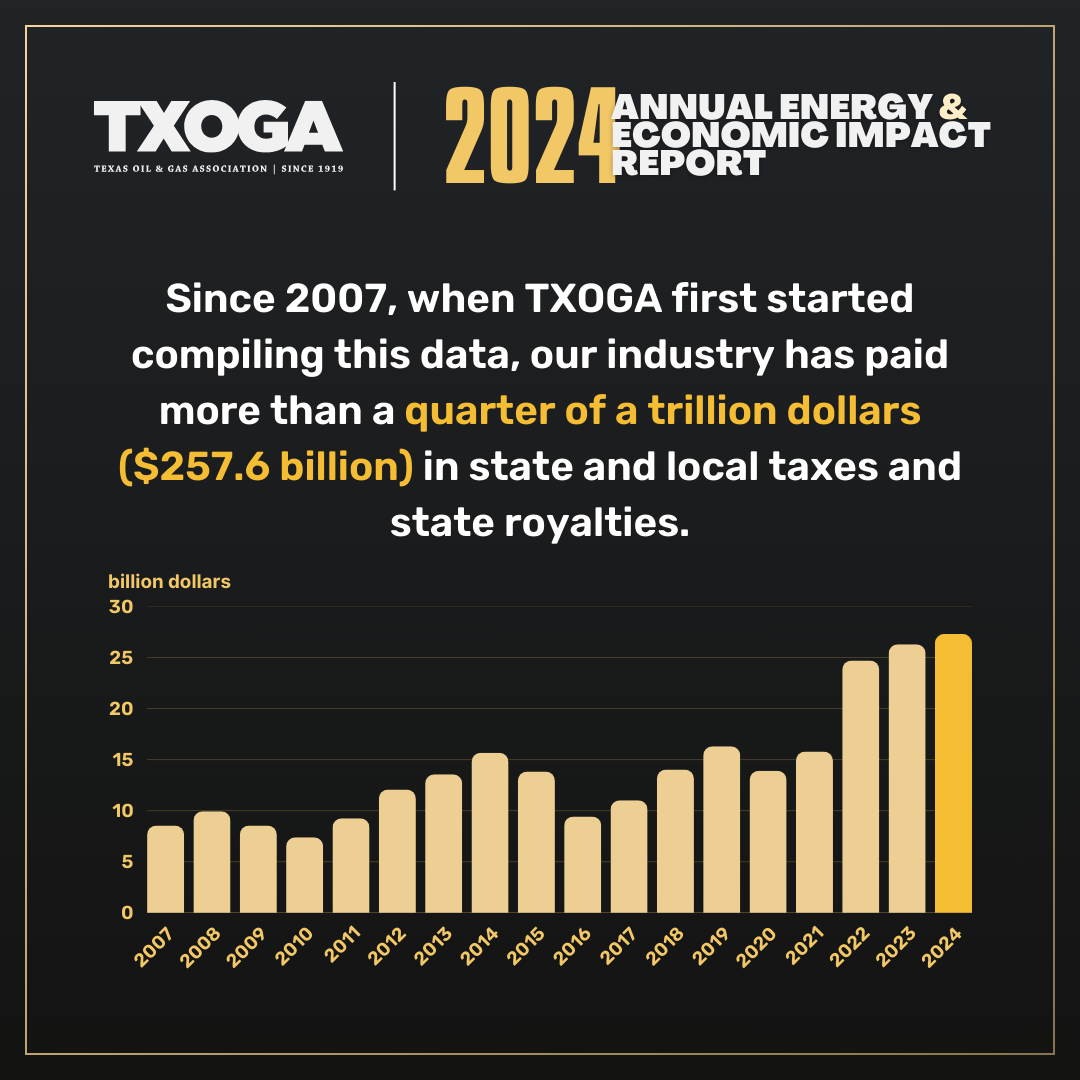

Tax revenue generated by robust oil and natural gas activity across Texas continues to be a game-changer for Texans, providing billions of dollars in funding for our state’s public schools and universities, roads, first responders, and essential services. The indispensable role this industry plays in Texas’ continued economic successes underscores the importance of policies that encourage responsible development of our natural resources.

The Texas oil and natural gas industry paid $27.3 billion in state and local taxes and state royalties in fiscal year (FY) 2024 – the highest total in Texas history – shattering last year’s record by $1 billion.

$27.3 billion in state and local tax revenue and royalties from the Texas oil and natural gas industry translates to an extraordinary $74 million every day that pays for Texas’ public schools, universities, roads, first responders and other essential services.