Billions in oil and gas taxes and royalties directly support Texas schools, teachers, roads, infrastructure and healthcare facilities

Texas ISDs received $1.54 Billion, Counties received $398.7 Million in oil and gas property taxes

January 14, 2020

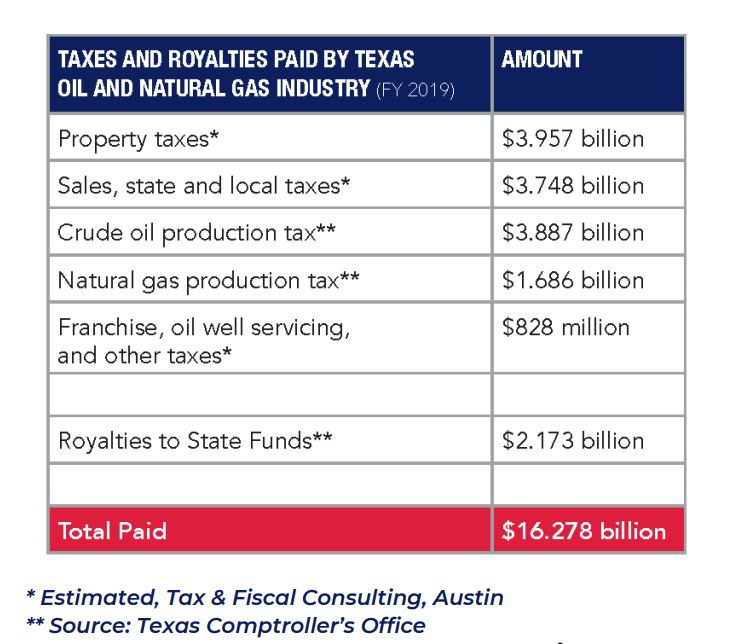

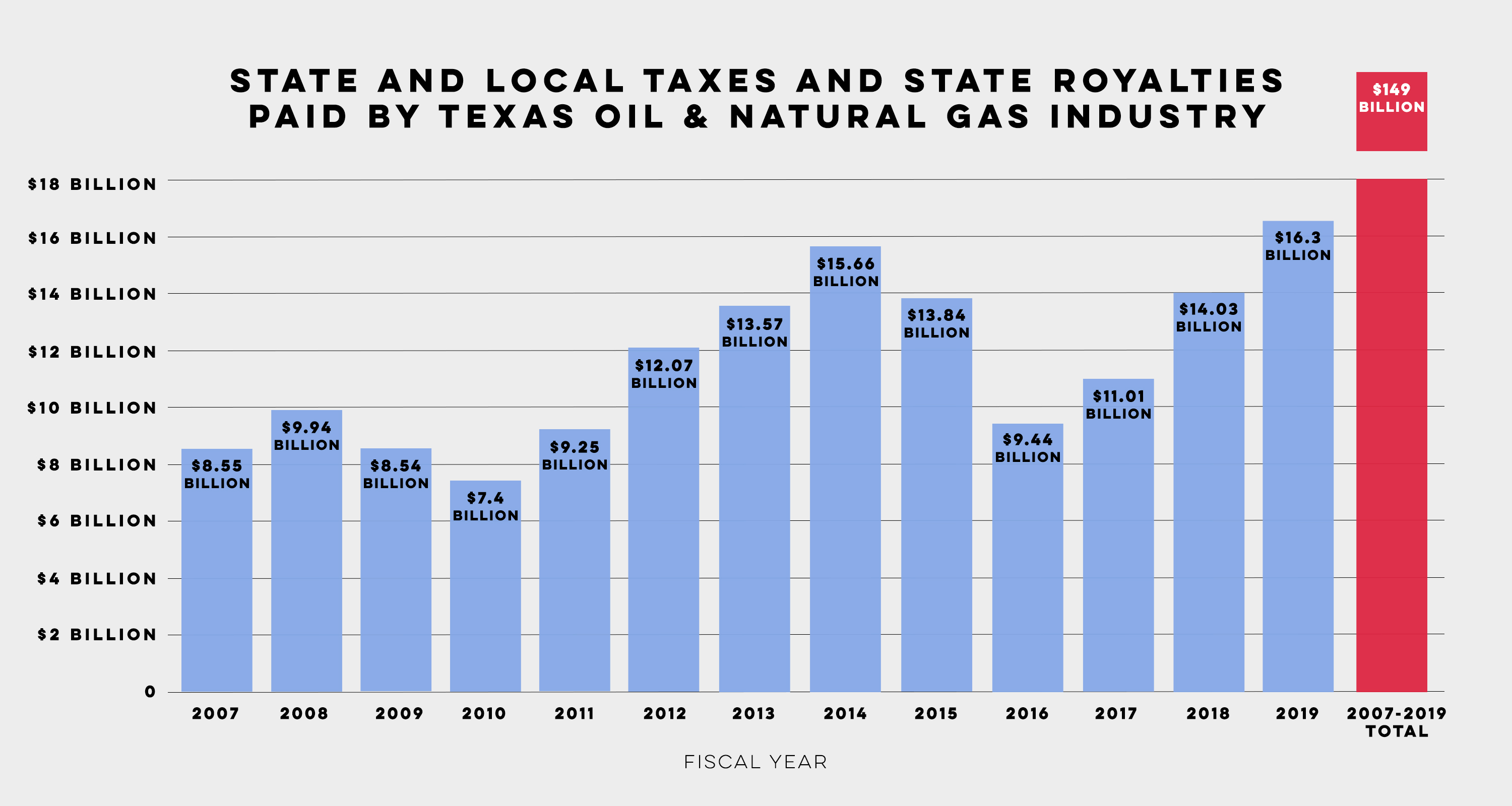

AUSTIN – According to just-released data from the Texas Oil & Gas Association (TXOGA), the Texas oil and natural gas industry paid more than $16 billion in state and local taxes and state royalties in fiscal year 2019 – the highest total in Texas history. TXOGA President Todd Staples hosted a media briefing this morning to share the new report and to provide a closer look at how Texas uses oil and natural gas tax revenue to benefit all Texans.

“Despite challenges in the global marketplace, state and local taxes and state royalties paid by the Texas oil and natural gas industry shattered records last year – exceeding $16 billion,” said Staples. “Continuous innovation and policies that encourage safe, responsible energy development are driving our nation, our state and our communities to new heights.”

“Oil and natural gas does more than fuel our cars, power our homes and businesses, form the building blocks of our everyday goods and secure our nation. Taxes paid by the oil and natural gas industry support teachers and schools, build roads, boost essential and emergency services, improve healthcare facilities and bolster our state’s infrastructure,” said Staples. “Since 2007, the oil and natural gas industry has paid more than $149 billion in state and local taxes and state royalties. That’s money that benefits every Texan – whether you live near the oil patch or not,” he said.

Staples detailed how oil and natural gas tax and royalty revenue is used to support education, transportation, healthcare and infrastructure through the State Highway Fund, the Economic Stabilization Fund (commonly known as the Rainy Day Fund), the Permanent School Fund and the Permanent University Fund – all of which are funded with taxes and state royalties paid by the oil and natural gas industry.

“The reach and impact our state can make with oil and natural gas activity here in Texas is incredible,” he said.

Other than interest from the Rainy Day Fund itself, 100% of the money in the Fund comes from taxes paid by oil and natural gas companies. During the last legislative session, Staples noted that lawmakers appropriated more than $6 billion from the state’s Rainy Day Fund toward many essential programs and initiatives including:

- Over $1.1 billion to the Texas Teacher Retirement System, with half this amount to be invested in the pension fund and the other half financing a “13th check” of up to $2,000 for retired Texas teachers.

- $807 million to the Texas Education Agency to help school districts affected by Hurricane Harvey, including for easing the financial losses to school district property values and for remediating school campuses damaged in the storm.

- $840 million to the Texas Water Development Board to develop and update flood risk maps across Texas and to provide grant funding for flood-related projects.

- $445 million to the Health and Human Services Commission to improve state hospital facilities.

- $125 million for grants to counties to plan, maintain, and reconstruct roads affected by oil and gas development.

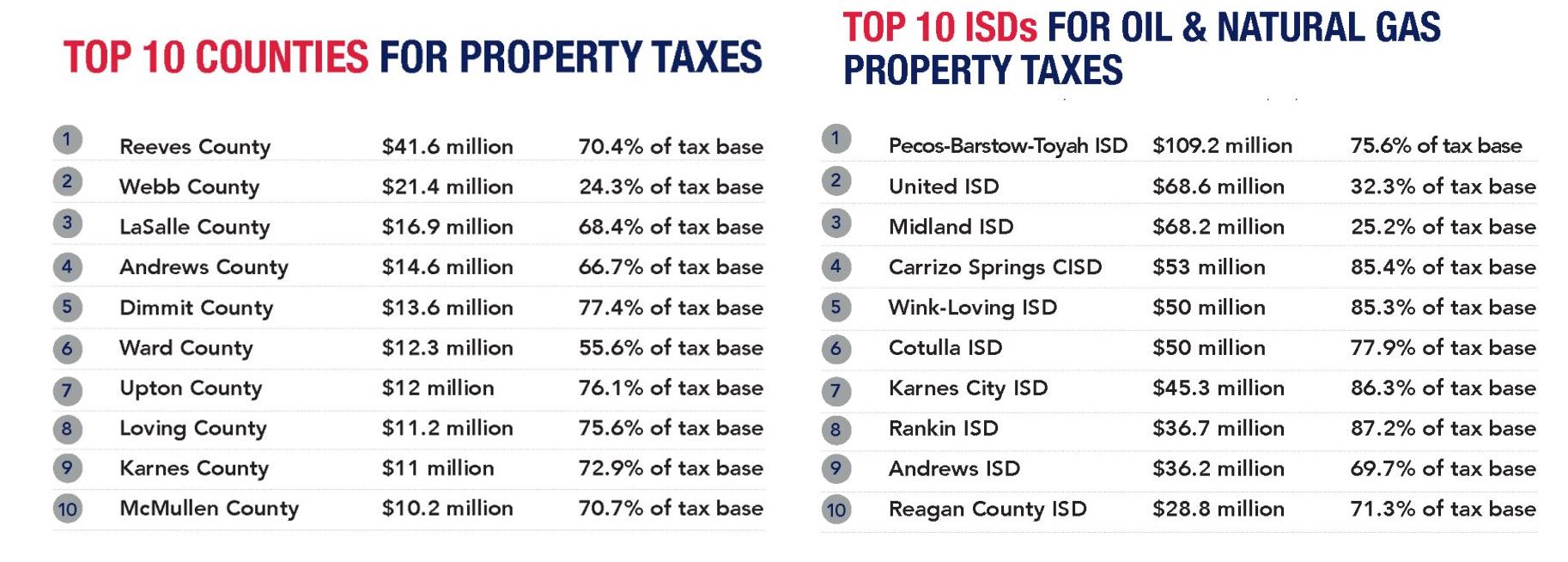

In fiscal year 2019, Texas school districts received $1.54 billion in property taxes from mineral properties producing oil and natural gas, pipelines, and gas utilities. Counties received $398.7 million in oil and natural gas mineral property taxes.

Property tax totals for each county

Property tax totals for each ISD

Some counties and ISDs saw dramatic increases in oil and natural gas property tax revenue in fiscal year 2019. Pecos-Barstow-Toyah ISD in West Texas ranked #1 receiving $109.2 million from mineral properties producing oil and natural gas, pipelines, and gas utilities – an increase of 266% from fiscal year 2018. Reeves County ranked #1 with $41.6 million paid in oil and natural gas mineral property taxes – a quadruple increase from last year.

In fiscal year 2019, 98% of the state’s oil and natural gas royalties were deposited in the Permanent University Fund and Permanent School Fund, which support Texas public education. The PUF received $1.02 billion and the PSF received $1.11 billion – contributions that broke records.

“Growth that drives these achievements is not guaranteed,” said Staples. “Texas’ commitment to science-based regulations and consistent policies, and the energy sectors’ ongoing investment in technology and innovation will ensure that our state and our nation can continue to lead the world in energy production, economic strength and environmental progress.”

Historically, TXOGA has defined the oil and natural gas industry using 10 sectors that cover upstream, midstream and downstream operations. This year, TXOGA included four additional sectors to provide a more comprehensive view of the industry including industrial sand mining, pipeline construction, oil and grease manufacturing and fuel dealers. Even without the addition of these 4 sectors, fiscal year 2019 was a record breaking year in terms of state and local taxes and state royalties paid by the Texas oil and natural gas industry.

“Oil & natural gas” means mineral properties producing oil and gas, pipelines, and gas utilities. It does not include refineries, petrochemicals, or other properties.

+++

Founded in 1919, TXOGA is the oldest and largest trade association in the State representing every facet of the Texas oil and natural gas industry.