AUSTIN – The following is an analysis by Texas Oil & Natural Gas Association (TXOGA) Chief Economist Dean Foreman, Ph.D.:

The U.S. Energy Information Administration (EIA) – the U.S. government’s official source for energy data and trends – has issued projections of global oil demand growth.

As natural gas production in the U.S. and Texas recently hit new highs, domestic prices have remained around $3 per million British thermal unit (Btu), despite record natural gas exports and domestic consumption above its five-year range.

The net effect of supply outpacing demand has been a remarkable productivity story for the oil and natural gas industry, where the U.S. rig count as of October 27 was down by 25% year-over-year (y/y), yet domestic natural gas marketed production rose by 3.0% y/y, according to data from Baker Hughes and the U.S. Energy Information Administration (EIA).

Notably, U.S. natural gas supply growth has been led and enabled by Texas, which has contributed more than half of nationwide growth. Together Texas and New Mexico, which depends on Texas’ infrastructure to process and deliver natural gas to consumers, have accounted for 80% of U.S. natural gas growth since last year.

And the future appears it will require far more natural gas, which is a needed complement to the growth of intermittent generation sources in electricity generation but also to meet an increasing international need for U.S. natural gas exports, especially in the wake of the Russia-Ukraine and Israel-Hamas wars.

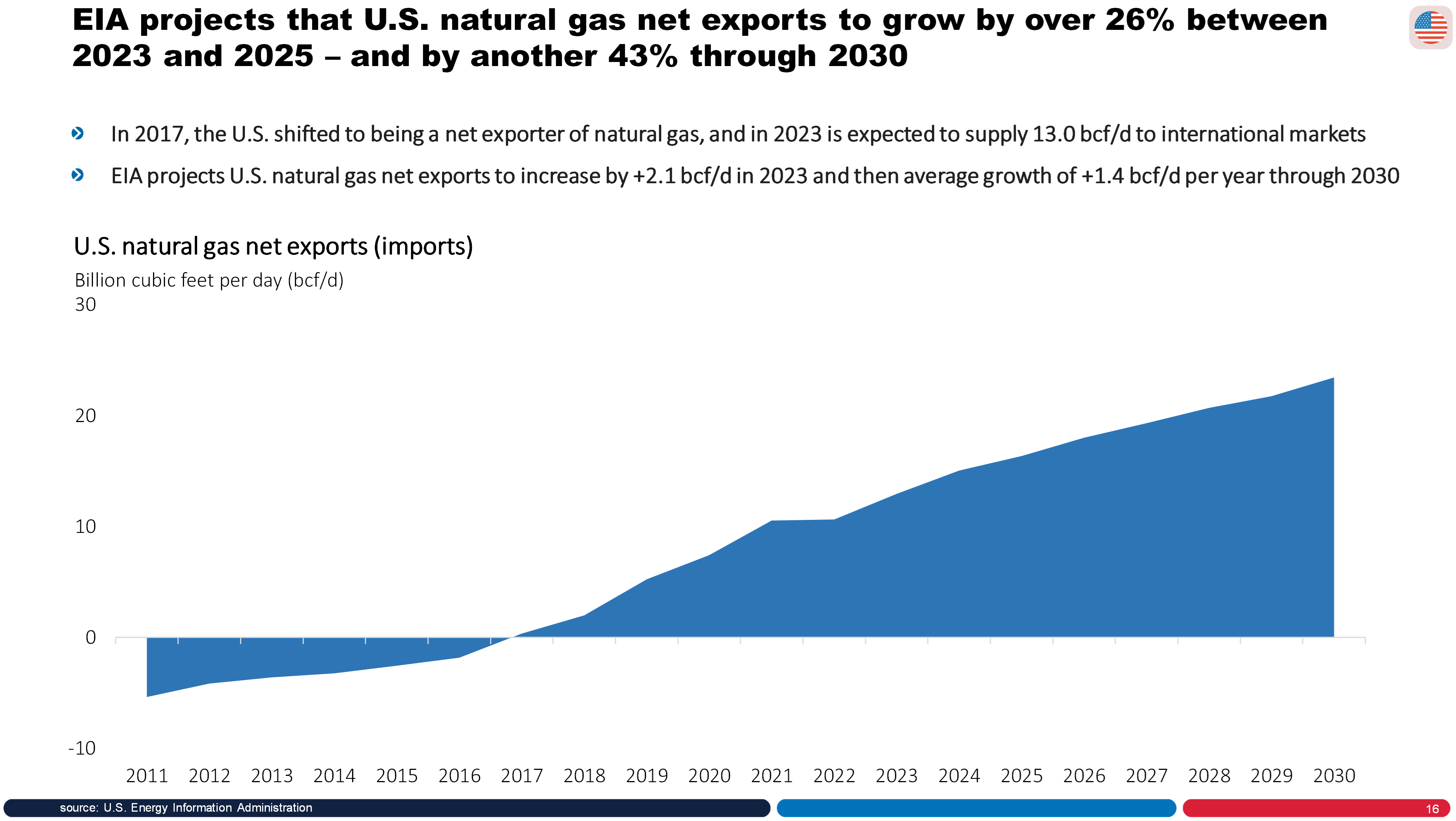

It’s clear that investing billions of dollars in international natural gas developments and transportation infrastructure is fundamentally incompatible with proximity to a war zone. In fact, before war broke out in the Middle East, the EIA projected natural gas net exports to grow by more than 80% between now and 2030. Their key assumption, however, is that this could be made possible by the U.S. needing less natural gas for domestic power generation.

While EIA’s outlook has been influenced by their assumptions about the Inflation Reduction Act of 2022, it represents a significant change within a short period, which, for U.S. natural gas exports, requires industry development, permitting, and affirmative investment decisions in the near future.

In turn, the compatibility of such strong natural gas exports with the economic interests of American households likely cannot exist without far greater domestic production, processing, as well as pipeline and export infrastructure.

There seems to be a disconnect between the U.S. energy outlook and the Biden Administration’s current policies regarding resource access, permitting, and infrastructure. It might be speculated that the Administration hopes rising exports without matching production growth will push domestic prices up, furthering a move away from fossil fuels. But expecting the industry to invest in future production, infrastructure, and exports without a consistent value chain is unrealistic.

It’s essential for the Administration to prioritize pragmatic policies that encourage domestic production over political maneuvering.

Now, diving deeper into the EIA’s forecast:

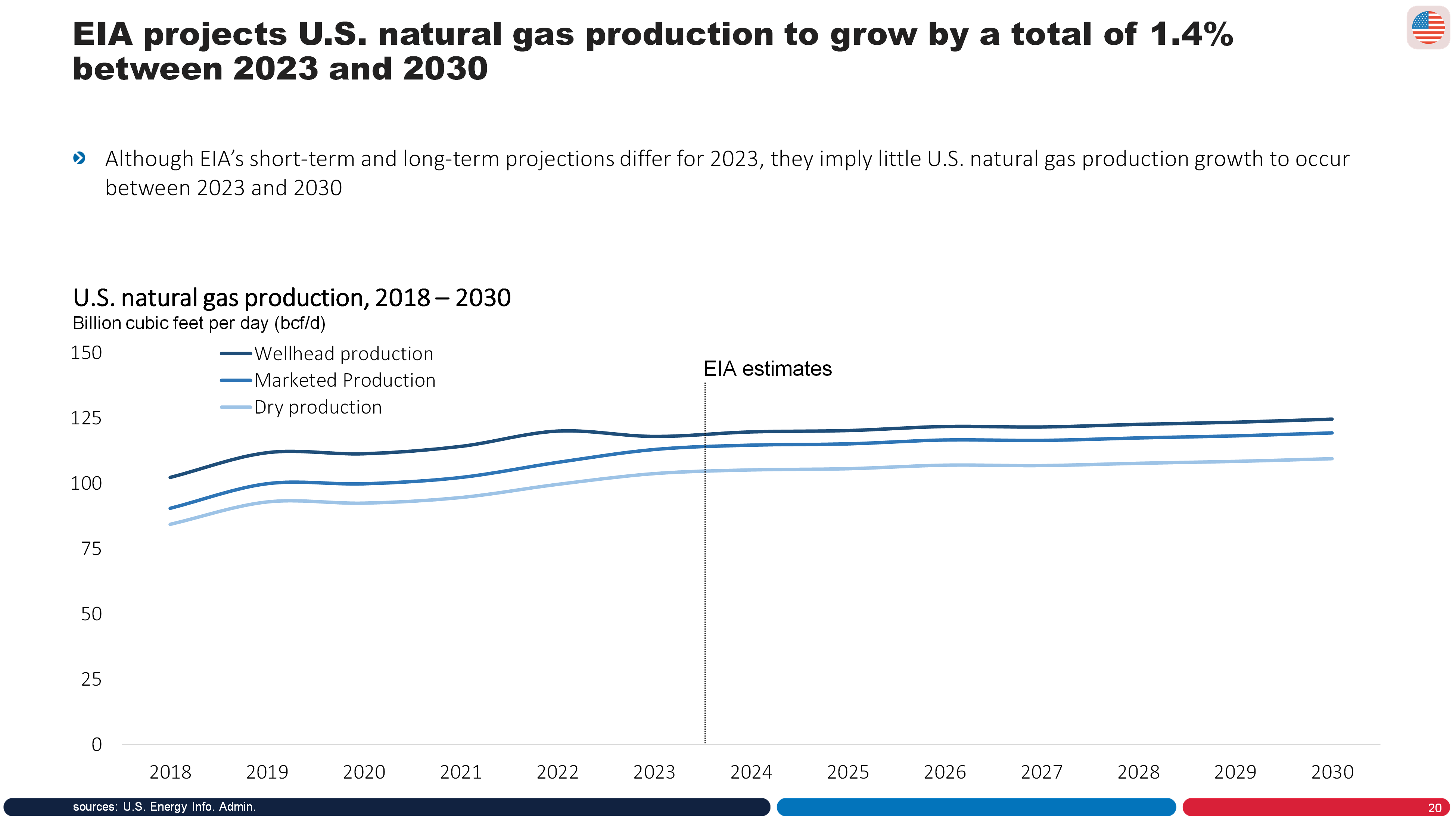

The EIA anticipates the U.S. will produce an average of 103.7 billion cubic feet per day (bcf/d) of dry natural gas in 2023. The growth from 2023 to 2030 is a modest 1.4%. In contrast, they expect U.S. natural gas net exports to increase by more than 80% over the same period.

Moreover, the EIA predicts that domestic natural gas prices will stay at around $3 per million Btu, even if the growth in exports consistently surpasses production. This scenario is feasible only if domestic natural gas needs decrease. Indeed, the EIA assumes a 29.1% reduction in natural gas consumption in the electric power sector from 2023 to 2030. This view is without precedent, however, since the U.S. hasn’t seen two consecutive years of reduced natural gas use in power generation since EIA started recording these data in 1997.

By comparison, EIA’s 2021 Annual Energy Outlook estimated that U.S. natural gas demand in power generation would remain steady near record levels between 2023 and the end of the decade.

Without concrete evidence suggesting U.S. consumers will need less natural gas, relying solely on the EIA’s model could misguide policymakers. A short-sighted view could lead to an oversight in shaping effective energy policies that the data support: sustained natural gas consumption and export growth. After all, natural gas remains the most cost-effective solution to stabilize the electricity grid against intermittency, as evidenced by Texas’ and California’s increases of 8.3% y/y and 5.5% y/y respectively, in natural gas consumption for power generation so far in 2023 per EIA.

The U.S. natural gas landscape highlights the interaction of geopolitics, domestic policies, market dynamics, and infrastructure challenges. Recent events only heighten the urgency to diversify supply chains, while the Administration’s policy stance reveals the complexities and hard economic realities of transitioning to cleaner energy sources.

But the data are clear: natural gas remains a crucial and pivotal energy source, and its efficient management requires a pragmatic, forward-looking policy approach. It’s imperative for policymakers to prioritize a realistic and sustainable strategy that aligns with the energy realities of today and the demands of tomorrow.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.