The following was written by Dean Foreman, Ph.D., Chief Economist at the Texas Oil & Gas Association (TXOGA):

In the Texas Oil & Gas Association’s (TXOGA) Quarterly Energy Economics Review for the first quarter of 2025, the economic and energy trends we have highlighted over the past two quarters—abundant liquidity, low interest rates fueling asset price appreciation, and sustained consumer spending supporting growth—have largely materialized as expected. However, the significant risks and uncertainties we previously identified, including rising consumer debt and delinquencies, an exceptionally strong U.S. dollar, and the potential for disruptive shifts in trade and supply chains, are now coming into sharper focus.

As we assess the first quarter of 2025, the U.S. economy appears to be starting from a position of relative strength. However, the widespread expectation since the 2024 presidential election that the U.S. would impose broad new tariffs has contributed to an accelerated purchasing cycle. This initially boosted economic indicators but may set the stage for a subsequent slowdown, particularly if financial markets retreat.

Oil and Natural Gas: Demand Remains Strong, But Uncertainties Loom

Global demand for oil and natural gas is on track to reach record highs in 2025 and 2026, despite economic uncertainties. In fact, global oil demand, which averaged 102.8 million barrels per day (mb/d) in 2024, is projected to set its fourth consecutive record high in 2026 at 105.2 mb/d, according to the U.S. Energy Information Administration (EIA).

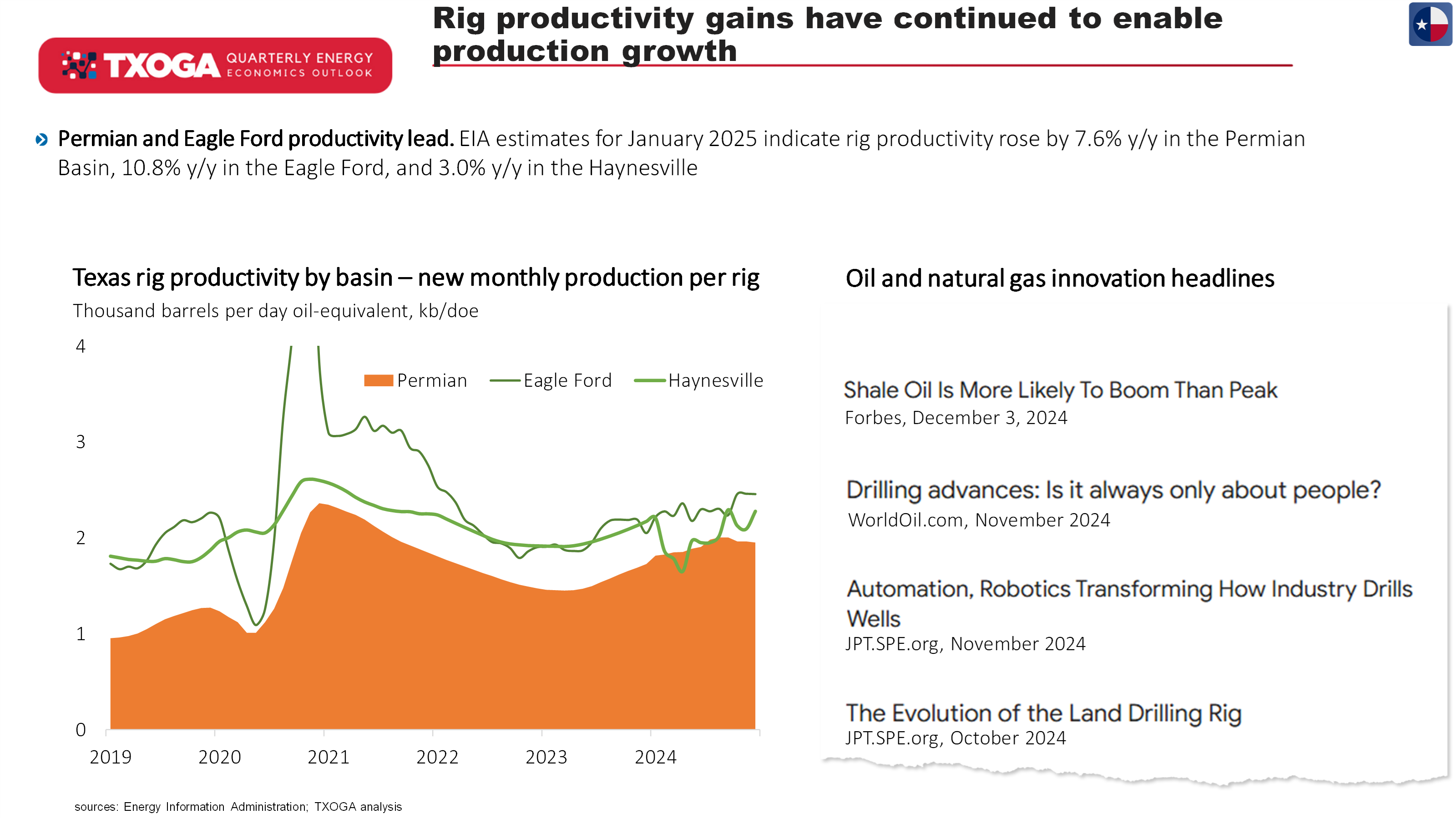

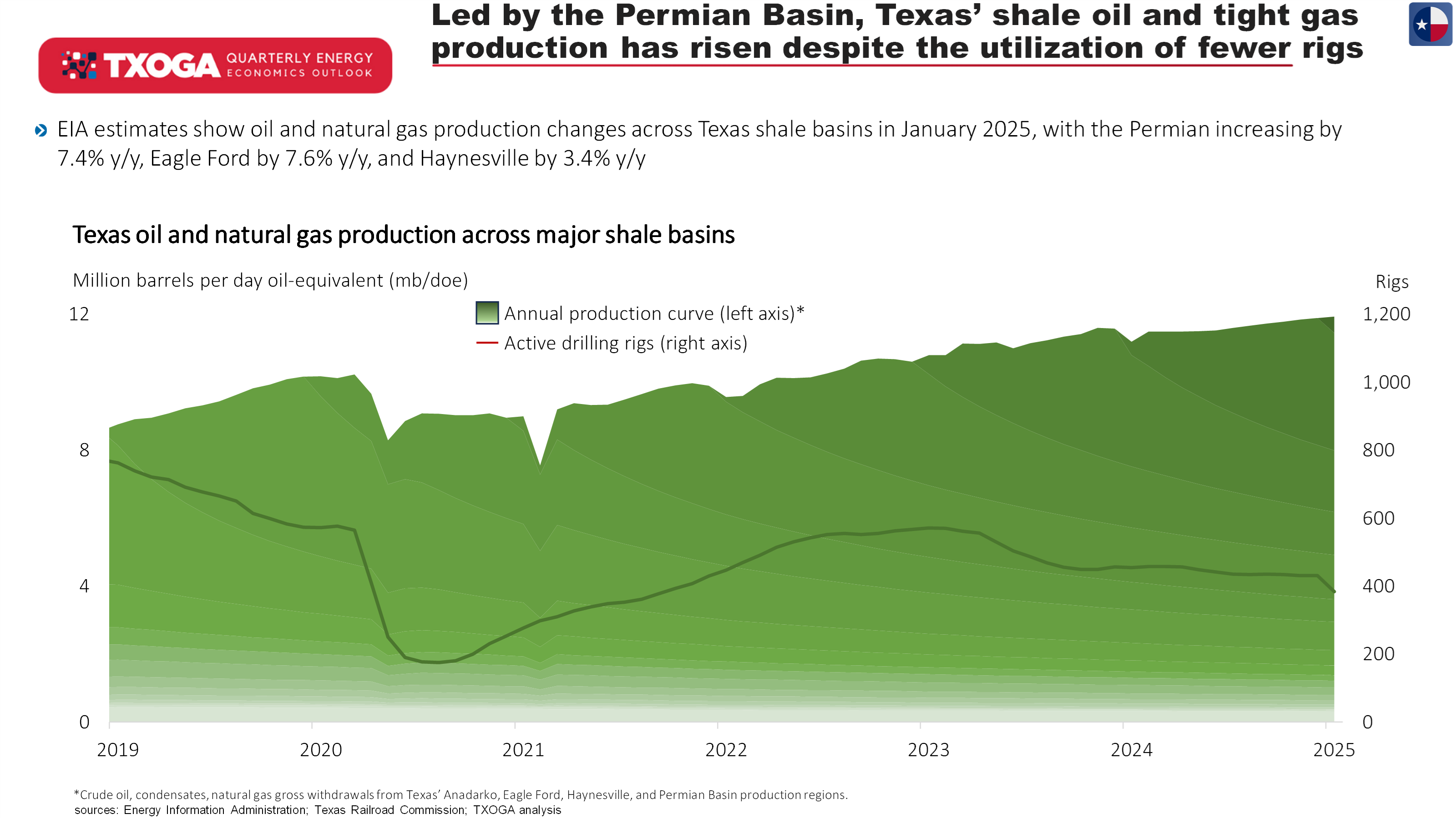

However, the balance between supply and demand differs between oil and natural gas. Oil markets remain well supplied amid robust demand and expanding international trade. The U.S., underpinned by exceptional rig productivity gains, remains the world’s largest source of oil supply growth, projected to add 0.5 mb/d. Other non-OPEC producers—Guyana, Brazil, Norway, and Canada—are collectively expected to add over 1.0 mb/d in 2025, though growth may slow in 2026, according to the EIA. If this scenario materializes, OPEC+ may still find room to increase supply without tipping the market into oversupply. However, OPEC+ recently announced their intention to increase output by 2.2 mb/d over the next 18 months, which does not appear to be completely reflected in futures prices and without offsetting factors could affect the market’s overall balance.

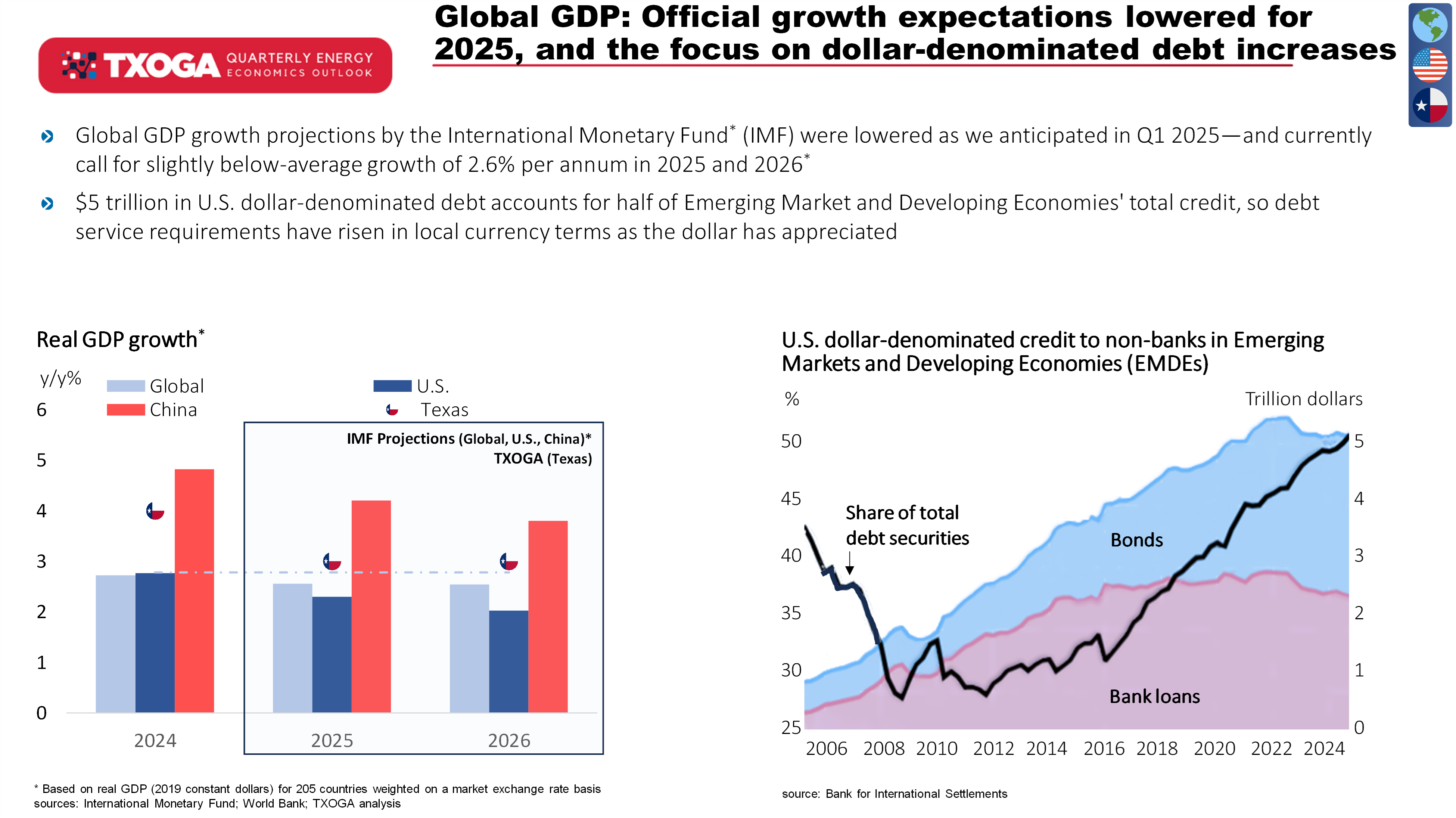

Global economic uncertainties could also test the balance. The International Monetary Fund (IMF) began the year with a series of economic downgrades, while the Bank for International Settlements (BIS) published research suggesting that pre-election announced tariffs, combined with retaliatory measures, could reduce global GDP growth by 1.5 percentage points and U.S. GDP by over 2.0 percentage points. A downturn of this magnitude could reduce oil demand by up to 1.0 mb/d. Additionally, as the U.S. dollar reaches an all-time high, the debt burden on emerging markets—where $5 trillion in U.S. dollar-denominated debt accounts for half of total credit—has risen significantly in local currency terms, raising concerns about sovereign debt sustainability.

Trade, Tariffs, and Implications for Texas

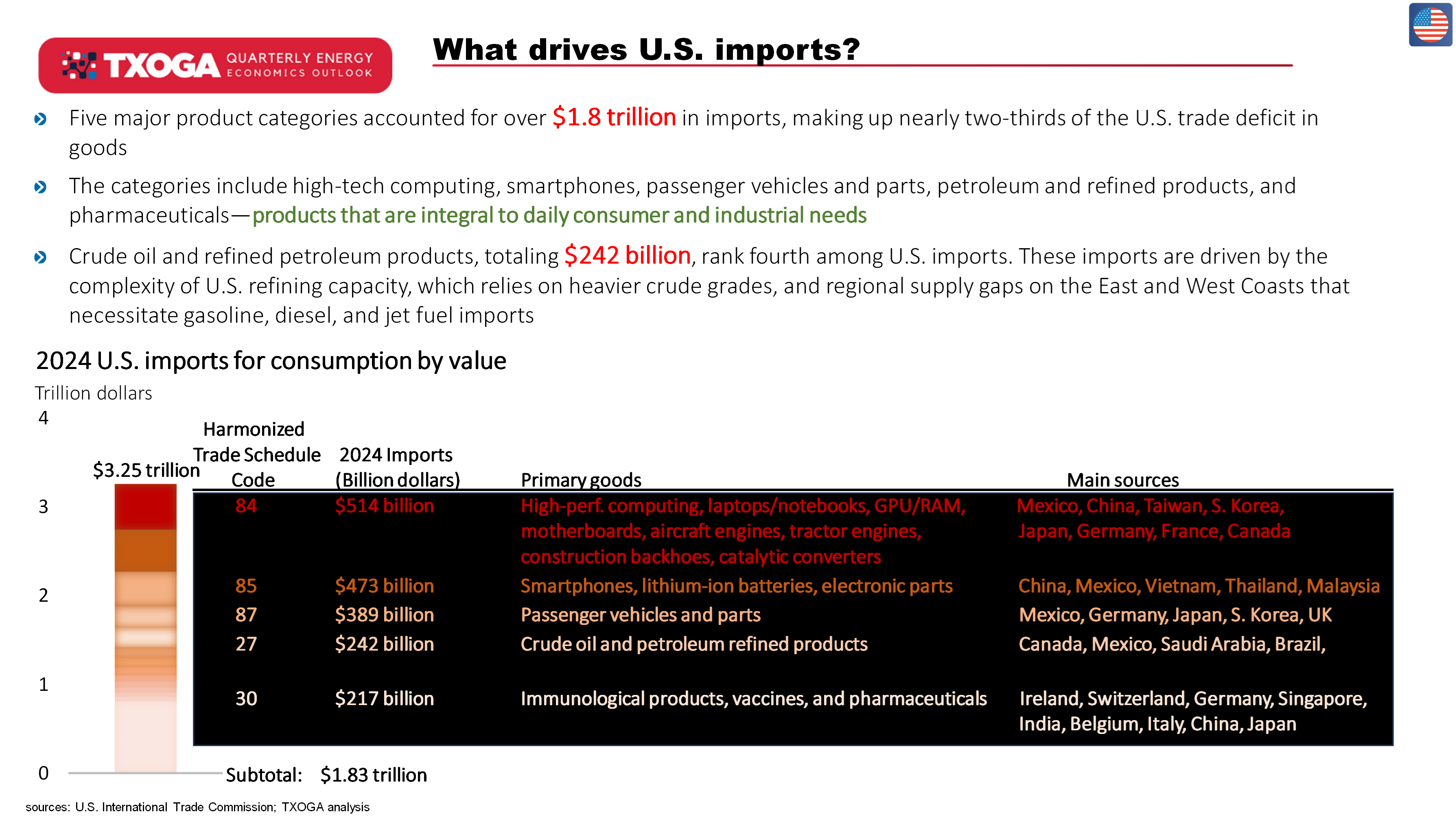

Trade policies are of particular consequence for Texas, which has invested heavily in serving international markets. When examining U.S. imports holistically, five key product categories accounted for nearly $1.8 trillion in imports and nearly two-thirds of the U.S. trade deficit in goods in 2024.

Notably, the top category with $514 billion of 2024 imports includes high performance computing, processors and memory, computers plus critical components for aircraft and autos. Another $473 billion is in smartphones, batteries, and other electronic components. This represents nearly $1 trillion per year of goods that nearly every individual and business need, but are heavily dependent on international sources to meet U.S. demand. The next largest category is $389 billion of passenger vehicles and parts, much of which represents supply chains integrated across North America. Crude oil and petroleum products represent $242 billion of imports, largely due to the need for imports on the U.S. East and West Coasts, but also due to the need for dense oil grades, largely available from Canada or Venezuela, for which refiners have sunk investments in across the Midwest and Gulf Coast states. Last but not least are pharmaceutical imports of $217 billion, primarily immunological products and vaccines from Europe and other countries.

Focusing tariffs on these categories—especially those involving top U.S. trading partners such as Mexico, Canada, and China—could generate hundreds of billions of dollars in federal revenue, potentially offsetting the expiration of 2017 tax cuts passed under the first Trump Administration. However, the key concern among economists is the risk of inflation and further tightening of labor markets, particularly in sectors such as food service, agriculture, construction, and manufacturing.

While tariffs are not inherently inflationary, the lack of viable substitutes for many of these imports in the short term makes inflationary pressures more likely. Consumer sentiment surveys have declined so far in 2025, as household debt and delinquencies reach historic highs. Contrary to the post-pandemic assumption that inflation primarily impacted lower-income households, rising delinquency rates and an increasing number of affluent households making only minimum credit card payments suggest broader financial stress.

Market Implications: Oil Stability vs. Natural Gas Volatility

Despite these economic uncertainties, global oil prices remain near $65 per barrel—an historically moderate level that does not indicate a downturn, but also does not suggest imminent market tightening.

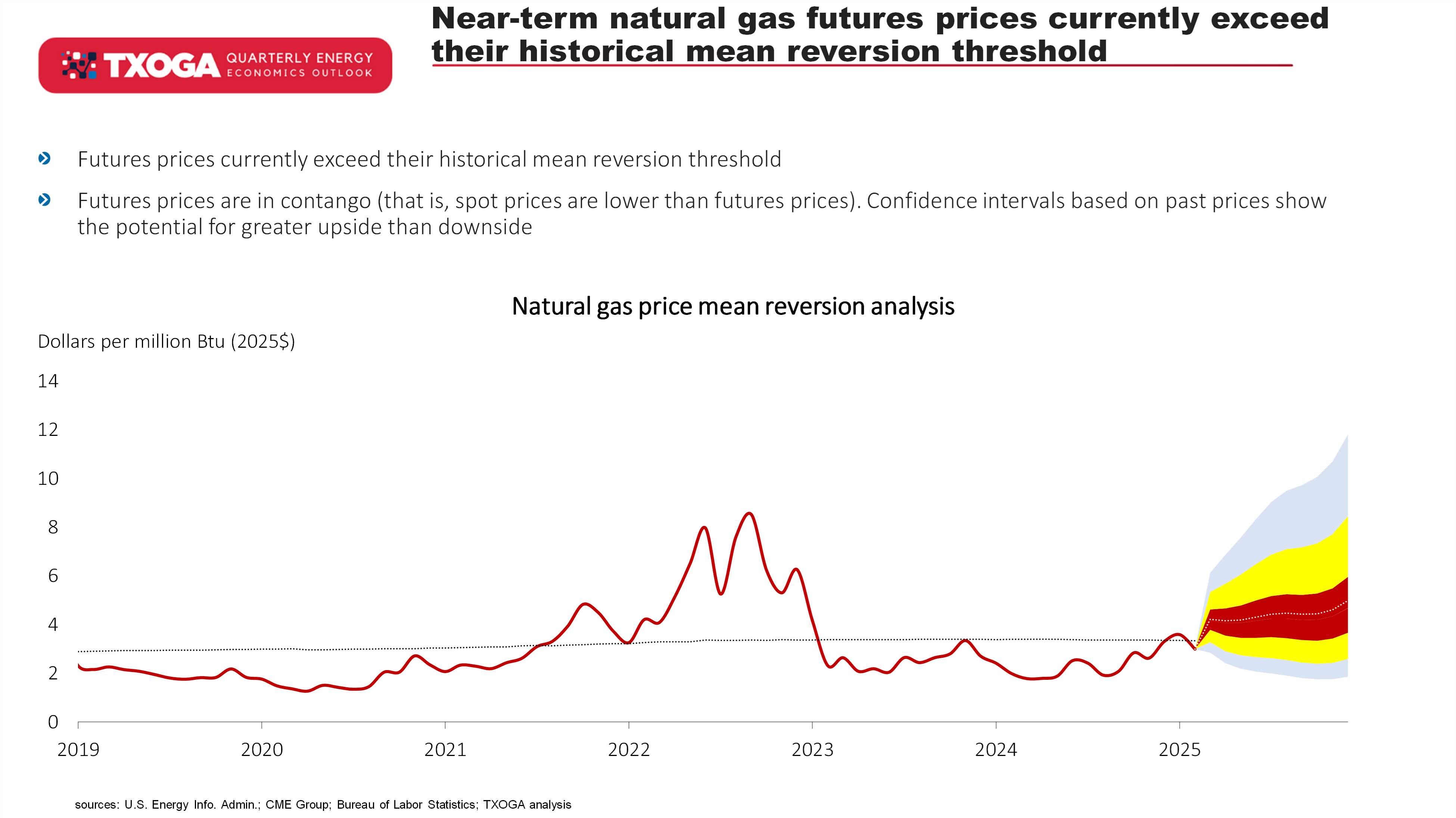

Natural gas markets, on the other hand, are exhibiting greater volatility. In our previous outlook, we noted that even a return to normal winter seasonality could highlight the growing role of U.S. natural gas inventories in stabilizing European and Asian markets. That prediction has largely materialized. Domestic natural gas prices, which currently exceed $4 per million Btu, have reached a winter seasonal high, with futures prices trending upward. Based on historical patterns, the market anticipates a tighter supply/demand balance for the remainder of 2025. Whether this shift is seasonal or structural remains a key factor to watch.

The Resilience of Texas Energy

For the market to bet against the resilience of U.S. oil and natural gas production, it would require an implicit assumption that productivity gains in the oil patch will slow. However, Texas’ fundamentals tell a different story. Rig productivity gains continue to translate into strong basin-level production, particularly in the Permian Basin. Moreover, ongoing advancements in analytics, data visualization, and AI are enhancing operational efficiencies and boosting resource recoveries. For these reasons, we expect productivity gains to persist despite potential capital constraints in the industry.

Our message last quarter was clear: “Don’t mess with Texas!” This quarter, we double down: “Underestimate Texas at your own risk!” The past several years have reinforced that U.S. economic and energy growth is not just a matter of faith—it is rooted in generational advancements and opportunities. While near-term disruptions from policy shifts may occur, Texas’ resilience and adaptability position it for continued leadership in the global energy landscape.

Click here to read the Quarterly Outlook for Q1 2025.

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.