Texas ISDs received $1.84 Billion, Counties received $640 Million in property taxes from oil and natural gas production, pipelines and gas utilities

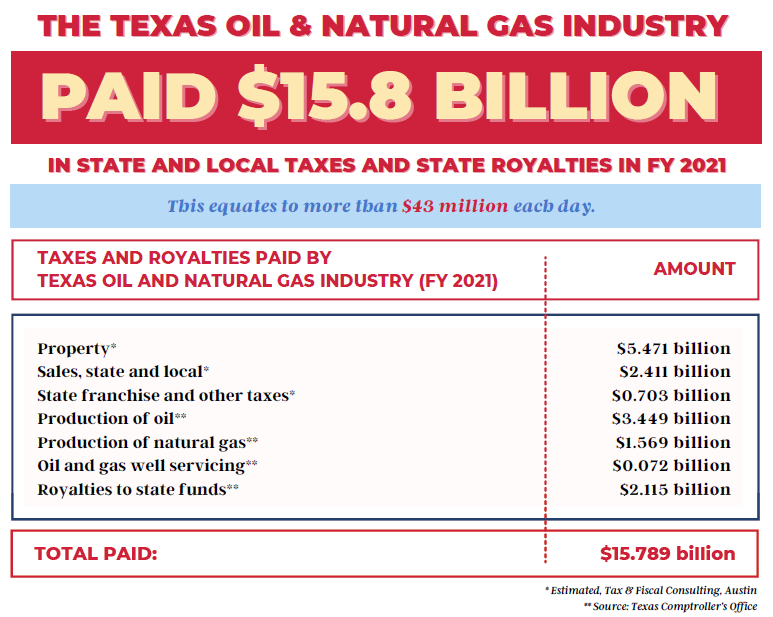

AUSTIN – According to just-released data from the Texas Oil & Gas Association (TXOGA), the Texas oil and natural gas industry paid $15.8 billion in state and local taxes and state royalties in fiscal year 2021, funds that directly support Texas schools, teachers, roads, infrastructure and essential services. TXOGA President Todd Staples hosted a media briefing today to share the Association’s Annual Energy & Economic Impact Report and to provide an update on the industry’s environmental progress and economic and environmental threats posed by federal energy policy.

“As our nation continues its rebound from the lingering impact of the pandemic, this data confirms reliable, affordable energy, fuels and products made by the oil and natural gas industry are central to continued economic and environmental progress,” said Staples.

$15.8 billion translates to well over $43 million every day. Both state royalties and production taxes increased by more than 20% in fiscal year 2021 and production taxes exceeded $5 billion for only the third time in history.

Staples detailed how oil and natural gas tax and royalty revenue is used to support education, transportation, healthcare and infrastructure, both locally in communities across Texas and through royalty and tax revenue that’s paid into the Economic Stabilization Fund (commonly known as the Rainy Day Fund), the Permanent School Fund (PSF) and the Permanent University Fund (PUF) – all of which are funded almost exclusively with taxes and state royalties paid by the oil and natural gas industry.

In 2021, 98% of the state’s oil and natural gas royalties were deposited into the Permanent School Fund and the Permanent University Fund, which support Texas public education. The PUF received $979 million and the PSF received $1.099 billion. The Rainy Day Fund received $1.134 billion from oil and natural gas production taxes.

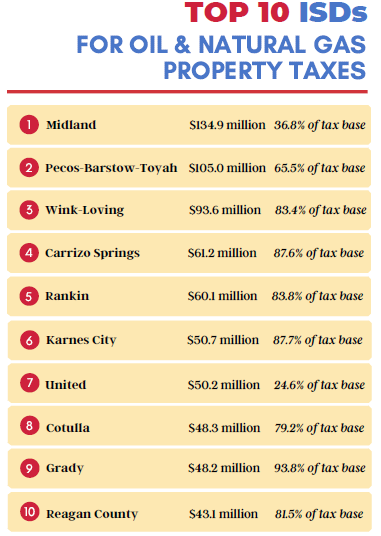

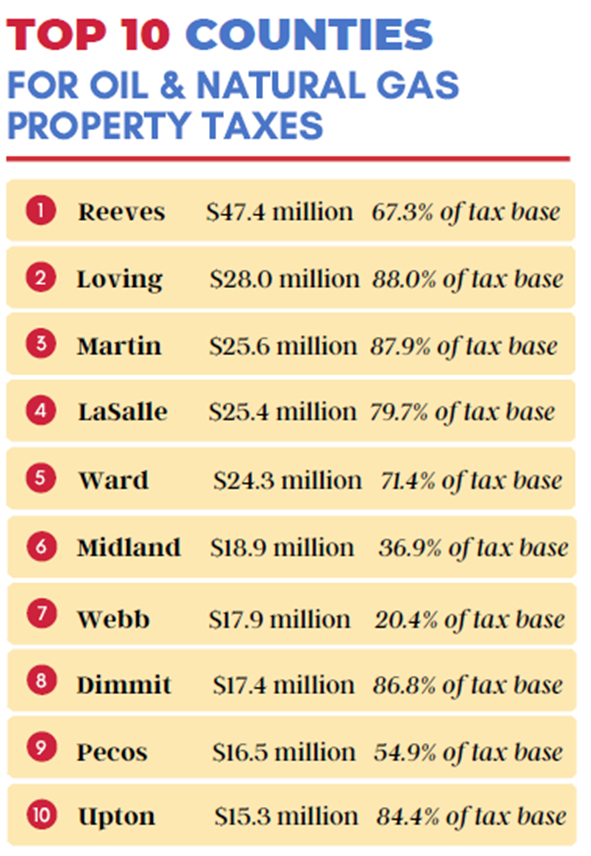

In FY 2021, Texas school districts received $1.84 billion in property taxes from mineral properties producing oil and natural gas, pipelines, and gas utilities. Counties received $640 million in these property taxes.

Property tax totals for Texas counties

Property tax totals for Texas ISDs

Midland ISD in West Texas ranked #1 receiving $134.9 million from mineral properties producing oil and natural gas, pipelines, and gas utilities. Reeves County ranked #1 with $47.4 million paid in oil and natural gas property taxes.

Since 2007, when TXOGA first started compiling this data, the Texas oil and natural gas industry has paid more than $178.7 billion in state and local taxes and state royalties, a figure that does not include the hundreds of billions of dollars in payroll for some of the highest paying jobs in the state, taxes paid on office buildings and personal property, and the enormous economic ripple effect that benefits other sectors of the economy.

In 2021, the industry employed 422,122 Texans who on average earned $109,000 dollars each – almost double the average pay compared to other private sectors. And for every direct job in the industry, conservative estimates indicate that an additional 2.2 indirect jobs are created. In total, 1.37 million Texans’ jobs ultimately derive from the Texas oil and natural gas industry.

In addition to its economic impact, Staples described the unmatched investments by the oil and natural gas industry that have positioned the United States as the global leader in energy and environmental progress. “Methane emissions are down dramatically, even as oil and natural gas production increases. Flaring rates in Texas are at record lows and Texas-produced LNG is an environmental game-changer for nations around the world,” he said.

According to the Railroad Commission of Texas, the statewide flaring rate in Texas fell to a record low level of 0.2% in October. Texas has one of the lowest flaring rates of large oil and gas producing states in the country.

Staples noted, however, “This progress is under assault by federal policies designed deliberately to eliminate the oil and natural gas industry and all of the quality-of-life, environmental and economic benefits it provides. Our federal government is quite literally standing in the way of global environmental progress,” he said.

Staples noted that current federal policies that have canceled energy infrastructure projects and discourage federal oil and natural gas leasing permits directly undermine the domestic energy development that is driving this economy and propelling environmental progress here and abroad.

“We cannot sacrifice energy freedom for energy dependence. Squandering our nation’s energy might through misguided policy is a disservice to every American and a step in the wrong direction on the environment,” he said. “If the world is truly serious about climate progress, we need to be producing and exporting more natural gas – not less – to provide other nations with lower emissions-intensive energy resources.”

In the charts below, “Oil & Natural Gas” means mineral properties producing oil and natural gas, pipelines, and gas utilities. It does not include refineries, petrochemicals or other properties.

Texas ISDs received $1.84 Billion in property taxes from oil and natural gas production, pipelines and gas utilities

Texas Counties received $640 Million in property taxes from oil and natural gas production, pipelines and gas utilities

+++

Founded in 1919, TXOGA is the oldest and largest oil and gas trade association in Texas representing every facet of the industry.